Reputations can be made or lost in 2019

Three engineers are driving along in a car when it suddenly comes to a halt.

After a pause for thought, the mechanical engineer says ‘That was a bit sudden, I reckon it could be a mechanical problem, probably the camshaft drive belt has failed’.

‘Hmm’, muses the electrical engineer, ‘I didn’t hear any sounds of valves hitting pistons, so my guess is that it’s an electrical fault. It could be a failed alternator that let the battery go flat and we lost the ignition’.

‘Lighten up you guys’, pipes up the software engineer in the back seat, looking up from his laptop. ‘Why don’t we switch off the ignition, all get out, close the doors, get back in and start the car up again.’

Yes, I know it’s an old joke, but it sums up the problem facing engineers commissioning the new generation of software-enabled trains. Pretty well every system, and even sub-system, on the train is computer controlled with its own software that also has to interface with the train’s other systems. This is in addition to the hard-wired interfaces such as electric power supplies.

I came across a practical example during a recent run in a Great Western Railway Class 800. The Universal Access Toilet (UAT), which is the best thought-out in terms of user friendliness of those I have tried to date, was all lit up, but the door had lost power and wouldn’t lock.

When I reported this failure to a member of the on-board staff, she replied that it was a common issue and the toilet needed re-booting. The old joke refers.

NOT ALONE

Lest readers think that this is just a case of hide-bound traction and rolling stock engineers unable to cope with new-fangled technology, it is equally a problem in cutting edge aviation. The Lockheed Martin F-35 fighter is a case in point.

Its software has been released in ‘blocks’. The US Marines were first to declare the F-35 operational with Block 2B software, which provided limited war-fighting capabilities.

A year later the US Air Force sought the equivalent capabilities by ‘re-hosting’ Block 2B software onto its version of the F-35. There were no new capabilities involved, yet implementation of this Block 3i program took 500 test flights. ‘We had no idea it would take that much’ Lockheed’s Vice-President of F-35 Test & Verification told Aviation Week.

To meet the full military specification a further software block is being fitted. This took over 30 iterations of the software to implement. A particular issue has been the fusion of data from the many sensors feeding the plane’s computer systems.

Bombardier is not far behind the US Air Force with the Class 710. According to Arriva Rail London, the software has reached Version 27.

CODE

Clearly, there is a difference in complexity between a £90 million fighter plane and a £10 million Desiro City, but the issues are similar. An F-35 is quoted as having eight million lines of software code. The Ford motor company has boasted that its new GT car has 10 million lines of code in its 25 on-board computer systems that process data from 50 different sensors to monitor vehicle performance and behaviour, external environment and driver inputs.

To try and put a new train into this context, I asked various manufacturers how many lines of code featured in their latest products. Apparently I was showing my age.

Rolling stock software engineers talk in terms of ‘Program Organisation Units’ (POU). These are the equivalent of the Macros that we used to write to carry out various functions in spreadsheets and the like.

A programmer can develop a control algorithm for a specific task. This can include POUs which are reusable and can be stored in libraries for import into other control programs. What I have yet to find out, and I am sure a reader will know, is the number of lines of code in a typical POU.

What I do know is that a current train’s POUs will handle between 3,000 and 8,000 functional requirements. And that is before you start integrating third-party software such as brakes and other systems such as doors and even the UATs.

That’s the hard news. The hoped-for good news is that once you have got the software right and the trial train performs as advertised, you upgrade the software across the rest of the fleet to the definitive version and the next thing you know is that you are clutching a silver spanner for the most improved fleet.

Well that is the theory. And my colleague Mr Walmsley points out that it worked for him with the South West Trains Alstom Class 458 electric multiple-unit fleet. However, I suspect that software dependence has increased by an order of magnitude in the two decades since the Class 458 was designed.

And then there is interfacing with the signalling.

PRESSURE

As the Rail Delivery Group reminds us, ‘hundreds of new and refurbished-as-new carriages are to be rolled out in 2019’. Unfortunately some of them should have started rolling out in 2018. In normal times that would merely be embarrassing for train operators and manufacturers and annoying for passengers, never mind politicians seeking credit for the influx of new trains entering service.

But when this column is published it will be 341 days to 31 December. And when Big Ben strikes 12 and the fireworks start, it will be illegal to run rail passenger vehicles in public service that are not compliant with either the Rail Vehicle Accessibility Regulations or the Persons with Reduced Mobility Technical Specification for Interoperability (PRM-TSI).

While the rolling stock leasing companies (ROSCOs) will have made around 3,500 of their ex-British Rail passenger vehicles compliant, there are still sizeable fleets due to be replaced before the deadline, which will not be compliant and will turn back into pumpkins, or at least scrap, when midnight strikes on 31 December.

DELAY

Late delivery of new fleets, which were due to replace non-compliant vehicles, means that it may already be too late to make the change-over by the deadline. This is not, in itself, a show-stopper. There is provision for derogations or, more probably, short-term dispensations, to cover the extended service.

However, the trains being replaced are very old. And were I running a ROSCO I would have made sure that not a penny more was spent on these vehicles than was needed to get them to 31 December in legal running order.

It is of course possible to revise or extend examination schedules so that trains can run past the deadline. However, that requires acknowledging that the incoming replacements are late in the first place. And, more importantly, having confidence in the manufacturers’ revised delivery schedules.

TIMETABLES

What can’t be fudged is the link between new train deliveries and the introduction of new timetables based on the performance of the new equipment. A case in point is the December 2019 Great Western Railway timetable.

Because of the delays to the Great Western Electrification Programme (GWEP), the GWR fleet of Hitachi Class 800 bi-modes has been running under diesel power to current IC125 timings. Now, with all 57 Class 800 units delivered and the overhead line equipment energised to Newbury and Bristol Parkway, although not yet Cardiff, the new GWR High Frequency timetable, exploiting the journey time accelerations with electric traction, can go ahead with the December 2019 timetable change.

But will it? Following the May 2018 timetable debacle, Network Rail has established a Programme Management Office (PMO) with the task of reviewing ‘infrastructure, rolling stock and Route/Operator readiness for timetable change’.

According to informed sources, the PMO is setting the bar pretty high.

This wariness is likely to be echoed by the Department for Transport. Transport Secretary Chris Grayling, having been badly burned by the May meltdown after the Manchester – Bolton electrification failed to materialise in time, is likely to be equally ultra-cautious.

With electrification to Cardiff now put back to November this year (p12, last month), plus the Electro Magnetic Compatibility (EMC) modifications to the GWR Class 800 fleet still being negotiated, the PMO, not to mention DfT, could question whether December 2019 is a bit tight for GWR’s new flagship timetable. Any further slippage with the OHLE and we are in Manchester – Bolton territory.

PROSPECTS

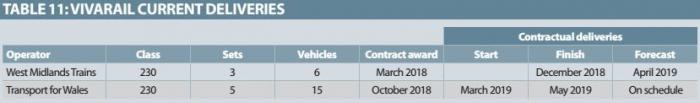

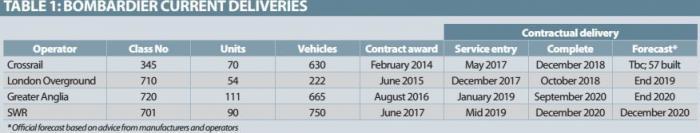

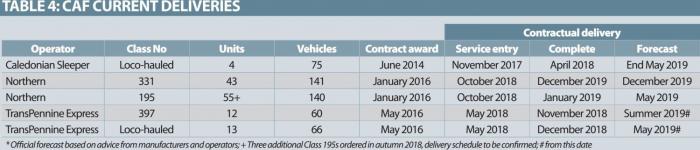

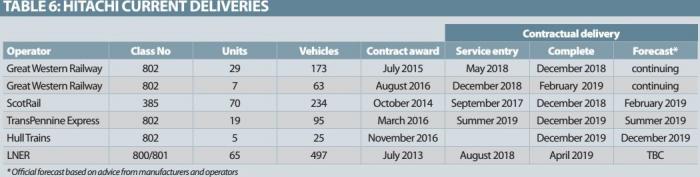

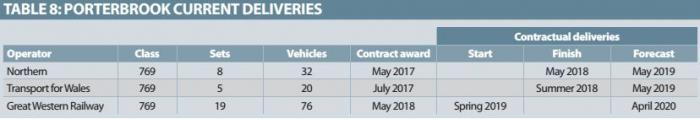

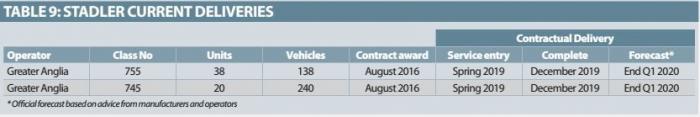

Having asked all the manufacturers for their latest delivery forecasts, as the following tables show I found a surprising lack of precision across the industry, with regular contravention of Informed Sources’ Third Law. There were also one or two cases where I had been unable to nail down a precise delivery date when the original contracts were announced.

BOMBARDIER

In this multi-dimensional pressure situation, how are the various train builders positioned to meet the 2019 delivery challenge? To avoid any suggestions of bias, I will assess their prospects in alphabetical order.

Bombardier conveniently illustrates the themes of software-enabled trains and replacing non PRM-TSI compliant rolling stock.

Crossrail deliveries in 2019 have become immaterial following the revelation that the project was running late, with no firm new date for opening.

Class 345 units have been in service for over a year, with 15x7-car sets (Reduced Length Units) running between Liverpool Street and Shenfield and nine-car full length units on test out of Paddington. While reliability continues to be poor, software issues have largely been down to signalling interfaces at the western end of Crossrail.

Running through the tunnels from Airport Junction to the Heathrow Terminals has been bedevilled by a conflict between the existing British Rail Automatic Train Protection (BR-ATP) signalling in the tunnels and the Level 2 European Train Control System (ETCS) installed for the Crossrail trains.

Balises for both systems work at the same frequency but the BR-ATP signal can swamp ETCS. This is exacerbated by the waveguide effect when running in tunnel.

Of the 70 Class 345 units, Bombardier has manufactured 57. Following the delay to the central core completion, production has been paused. However, by mid-December 2018 33 units had been accepted and ‘bought’ and Bombardier was hoping to have another four accepted by the end of the year.

NEW SOFTWARE

If the Class 345s are running in passenger service, why are the Class 710 Aventras for London Overground and the ‘720s’ for Greater Anglia still in the testing phase? The answer lies in the software.

For the Class 345s, Transport for London specified an evolution of the Class 378 ‘last generation’ software. However, the units for London Overground and Greater Anglia, and the other Aventra contracts for delivery beyond 2019, are true next generation trains with a new ‘family tree’ of software.

Bombardier openly admits that the issue is functionality – shades of the F-35. Siemens has also found this an issue in its drive to improve the reliability of the Class 700 units for Thameslink. A software drop intended to fix a specific problem can produce unintended consequences for another sub-system which you thought was sorted.

GOBLIN

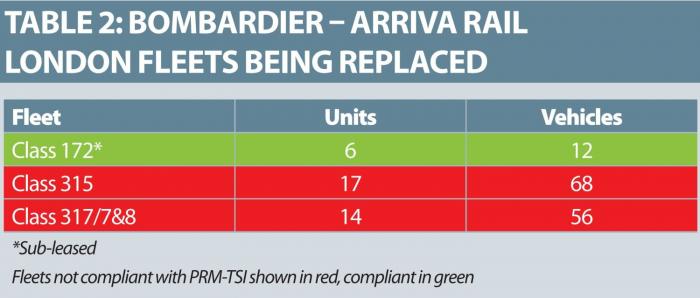

Currently the highest profile victim of late delivery is the Gospel Oak – Barking line. Rolling stock for the recently electrified route was to be provided from within the 45 Class 710 units ordered by Transport for London in June 2015.

Under the original order, which was subsequently increased to 48x4-car and 6x5-car units, 31 sets were to replace Class 315 and 317 EMUs operating the West Anglia and Romford – Upminster services that TfL took over from Greater Anglia. Eight of the remainder were earmarked for Gospel Oak – Barking.

Pending completion of electrification, this service had been operated by six Class 172 DMUs sub-leased from West Midlands Trains. This sub-lease had been due to terminate at the end of 2018, leaving the line without rolling stock. Two went off-lease last year and a further unit was due to go off-lease in late January; the leases of the remaining units all finish by March.

CASCADE THREAT

This highlights yet another penalty of late deliveries – the impact on cascades and the need for the receiving operator to act fast, rather than trust in the manufacturer to recover lost time. Yet again Scotland shows how to do it.

When the Hitachi Class 385 EMU fleet was delayed by signal sighting problems, Transport Scotland rapidly devised and implemented Plan B, bringing redundant Class 365 units north to replace DMUs on its extended electrified lines. Add in the inspired branding as ‘Happy trains’, from the mouth-like grille below the cab, and a potential embarrassment became a marketing success.

Meanwhile Transport for London has shortened an Arriva Rail London Class 378 to four cars. Following clearances tests on Gospel Oak – Barking it will be used to supplement the Class 172 fleet.

According to Bombardier, delivery of the Class 710 fleet is now due to be completed by the end of 2019. Given that the original date was September 2018, this is 15 months late. But with large numbers of Class 710 vehicles in storage, it also seems unduly pessimistic.

However, the key date is March 2019, when the Gospel Oak – Barking Class 172s have to be returned to West Midlands Trains. If they have not been replaced with Aventras by then, Greater Anglia will be getting nervous.

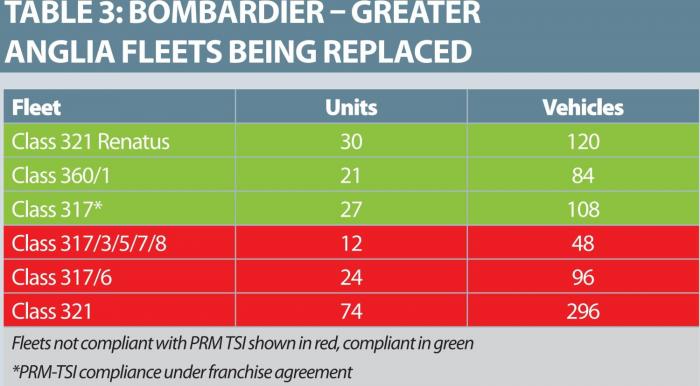

GREATER ANGLIA

Bombardier’s Aventra has swept the board since the mass extinction of existing fleets became the winning strategy in franchise bidding. Greater Anglia began the purge, including an order for 111 Aventra Class 720 EMUs – 665 vehicles. Delivery would run from January 2019 to September 2020.

All that has been said about the Class 710 software issues applies to the Greater Anglia Aventras. However, note from Table 1 that while delivery is late the forecast contract completion has slipped by only three months to the ‘end of 2020’.

To meet further Aventra orders extending beyond the scope of this review, Bombardier is increasing its production capability to match the scale of orders won by its new train design.

The intention is to have six Aventra production lines at the company’s Litchurch Lane site in Derby. Assuming keysub-contractors can ramp-up deliveries, six lines have the potential to turn out 24 vehicles a week

Table 3 shows the fleets they will be replacing. Note in particular that, except for the 30 ‘Renatus’ units, the Class 321 fleet is not compliant. In addition the non-Renatus fleet comes off lease on 31 October, placing more pressure on Aventra deliveries. The Renatus lease ends on 31 December 2019.

In the case of the Class 317 units, the Greater Anglia franchise agreement included PRM-TSI compliance modifications to 27 units.

In total, 110 non-compliant EMUs (440 vehicles) will have to be replaced by the end of the year with potentially 108 units/432 vehicles, including the 30 Class 379s, available to run into 2020 with short-term extensions to existing leases.

SWR

While it will require some judicious allocation of deliveries between the two main operators, Greater Anglia and South Western Railway, the order completion dates in Table 1 seem conservative. At least SWR does not have PRM-TSI issues. However, the owners of the EMUs affected by the SWR mass extinction may well be pressing for prompt release if new uses become available.

All this said, Bombardier and Greater Anglia probably face the greatest delivery pressures.

CAF

In contrast with Bombardier’s software problems, CAF deliveries have been delayed by old-fashioned mechanical problems, including braking systems. Caledonian Sleeper has been the worst offender. Ordered in June 2014, there have been two false dawns.

Planned for April 2018, service entry was deferred to October. With some of the sleeping cars still under construction, the launch is now scheduled for May 2019.

2016 was a good year for CAF, with four orders from Northern and TransPennine Express totalling just over 400 vehicles. At the time the contracts were awarded three were scheduled for completion by the end of 2018.

FACTORY ODE

Oh, the factories are busy in a regular tizzy,

And the obvious reason is because of the season

They should be deliverin’, contract lawyers are quiverin’ Spring, spring, spring. (With apologies to Seven Brides for Seven Brothers

NORTHERN

In the case of the Northern contracts, the Class 195 DMUs have slipped back to spring 2019. The intention had been to have three in service before the end of 2018, with the full fleet available for the May timetable change. Fortunately the pressure on delivery has been eased by Network Rail’s decision to defer Northern’s major ‘Northern Connect’ timetable upgrade from May to December 2019.

Service entry of Northern’s 43 Class 331 EMUs was originally scheduled to run from October 2018 to the end of 2019. The first unit has begun testing in the UK.

Northern is the prime example of political aspiration risk. Elimination of the Class 142 and 144 Pacer fleets became a manifesto commitment in the last general election. Withdrawal is already running late. Having to obtain a derogation to run into 2020 would be a major political embarrassment.

TPE’s ‘Nova 3’ loco-hauled fleet has also been delayed by systems integration involving a ‘technical issue with a key on-board system’ on the CAF Mk 5A coaches. Service introduction was scheduled for the end of 2018 but has now been deferred to that most popular contravention of Informed Sources’ Third Law, ‘spring’. According to TPE, the Nova 2 CAF Class 397 inter-city EMUs are still on schedule.

HITACHI

Along with Siemens, Hitachi shares the rare distinction of having completed delivery of a new-generation fleet. All 57 Class 800 five- and nine-car bi-modes for Agility Trains West – the company responsible for the train service provision contract with GWR – have been accepted.

Under the terms of the contract, Train 57, which at the time was expected to be a Class 801 electric multiple-unit, was scheduled to be accepted on 6 July 2018. As we know, with the Great Western Electrification Programme (GWEP) running late, the Department for Transport decided that the entire GWR fleet would have to be bi-modes, requiring a contract variation.

Then, because the delay to GWEP meant that the electrified section of the GWML for test running would not be available on time, a 90-day (12-week) extension was granted. This took deliveries up to the end of September 2018. So, three years after the contract was signed, with much buggeration in between, Hitachi was only three months late in delivering the final train.

Interestingly Siemens’ completion of the Class 700 Thameslink fleet was late by a similar amount. Of course, all the new fleets are struggling with reliability, and the Class 800s will require electro-magnetic compatibility (EMC) modifications to obtain full acceptance. But it is praiseworthy that both companies had their biggest fleets of brand-new designs running in passenger service so close to the original contractual dates.

Of the Class 802 bi-modes, ordered by GWR in two batches, 21 sets (20x5-car and 1x9-car) were in passenger service at the time of writing. The remaining 13x9-car and 2x5-car units will be delivered ‘over the coming months’.

SCOTRAIL

In Scotland, while the Class 385 EMUs were delayed briefly by braking issues during initial testing and then by the sighting difficulties requiring a new design of windscreen, 31 sets were ready for the start of the new electric services in December. The last of the 70 EMUs is on the shop floor at Newton Aycliffe and was due to be delivered in February.

Obviously, the bottleneck while the windscreens were changed affected driver training. However, compared with the original service date Hitachi is, again, only a couple of months late.

TPE

Delivery of the Class 802 fleet for TransPennine Express is scheduled for the ‘spring’ this year, with the whole fleet available in ‘early summer’. This is earlier than the ‘from December 2019’ when the contract was signed. Note, of course, that delivery in this review means accepted and handed over.

At the time of writing, three TPE Class 802s were at Hitachi’s Doncaster IEP depot for commissioning and testing and one had completed a run under the wires on the West Coast main line with no interference issues.

Also in the FirstGroup Class 802 stud are the 5x5-car bi-modes to replace Hull Trains’ self-combusting Class 180 DMUs. These are on

M’LEARNED FRIENDS INTERVENE

Intriguingly, the TPE Franchise Agreement was recently republished with the section on ‘termination rights prior to the Acceptance of the New Bi-Mode Vehicles, the New EMUs and the New InterCity Coaches’ apparently updated. This included the requirement that ‘The Franchisee shall keep the Secretary of State fully informed of progress in relation to the performance by:

‘(a) the Bi-Mode Vehicles Manufacturer of its obligations pursuant to the New Bi-Mode MSA (Manufacture and Supply agreement); and

‘(b) the EMU Manufacturer of its obligations pursuant to the New EMU MSA; and

‘(c) the InterCity Coaches Manufacturer of its obligations pursuant to the New InterCity Coaches MSA.

‘In particular the Franchisee shall keep the Secretary of State updated on progress in relation to compliance with the anticipated delivery schedule of each Relevant New Rolling Stock and risk that a Minimum Fleet Requirement Termination Right or any Manufacturer Events of Default Termination Right will become exercisable under the Relevant MSA prior to the date upon which all of the New Bi-Mode Vehicles, New EMUs or the New InterCity Coaches (as applicable) that have been ordered have been Accepted’.

CHOKING

I’m afraid I upset Hitachi with my estimated rule-of-thumb weight for a choke of 1-2 tonnes, which the company considered excessive. I had assumed fitment to the transformer driving cars and wrote in December that this could increase the weight from 52.8 tonnes to around 54 tonnes – 1.2 tonnes per car or 2.4 tonnes per five-car unit.

A recent presentation to Class 800/802 operators by the IET/EMC Joint Technical Strategy team reported that the chokes are to be fitted to the motored car inverters and have an estimated weight of 750kg each. This equates to 2.25 tonnes per five-car, making my estimate 6% out – not bad for a mechanical engineer.

Schedule for delivery by the end of this year, something which can’t come fast enough for the open access operator’s hard pressed engineers.

LNER

Sadly, the ‘Azuma’ Class 800 and 801 bi-mode and straight electric units being supplied through Agility Trains East (ATE) under the Intercity Express Programme to London North Eastern Railway (LNER) have come up against several pressure points. I asked Hitachi for comment on the LNER delivery programme, but the company referred me to the Department for Transport.

The DfT was asked for comment too; in the absence of any word by the printing deadline, here is my best stab at the delivery situation.

Numbering of the LNER units follows on from those for GWR. Under the original contract the first set, Train 58 (T58), was due to be accepted on 23 August last year. The 90-day extension put this back to 19 November.

With Newton Aycliffe at capacity, Hitachi sought to keep delivery on schedule by building more sets in Japan and ‘re-sequencing’ these to the start of the ECML schedule.

Thus the first eight trains (nine-car bi-modes to replace IC125), would be numbered T58, T60, T62, T64, T66, T68, T69 and T70. This would take deliveries to 24 January 2019 when Newton Aycliffe, having caught its breath, would chime in with the missing odd-numbered trains.

However, this was frustrated by ongoing EMC issues. According to informed sources, the ‘IET EMC joint technical strategy’ has agreed a threefold solution. First, as already reported, Network Rail is fitting ISPU to the vulnerable SSI data links. In parallel, Hitachi is also fitting new printed circuit cards to the traction packages.

These cards control the frequency of the output from the inverters that supply the traction motors. The new cards have been trialled on test sets and the greater switching precision has shown a reduction in emissions. They are now being fitted to production traction packages.

Finally, Hitachi has committed to fit filters, what this column calls chokes, to all Class 800 units. Unit No 802101 was being used for a trial installation during January with static testing in February. If dynamic testing is successful, fitment on both GWR and LNER units could start in June or July. Note that fitting of chokes is not a condition of the trains receiving qualified acceptance to run on the ECML. Once the ISPUs have been installed, trains with the new cards will be able to run in service.

This means that the 13x9-car bi-modes to replace the IC125 fleet (10 diagrams) should certainly be in service by the PRM-TSI compliance drop-dead date, plus a good proportion of the 30x9-car electric Class 801 units to replace the IC225s.

PORTERBROOK

With the creation of the Class 319 ‘Flex’ bi-mode conversion, re-designated Class 769, Porterbrook has added train re-purposing to its core leasing business. The company is not alone in seeking to extend the commercial life of ex-BR assets, with Eversholt proposing a hydrogen fuel cell bi-mode derivative of the Class 321 EMU.

As Table 8 shows, development of the Class 769 has been protracted. However, deliveries should now accelerate. Northern was expected to have two units by the end of January, with the remainder of the fleet delivered by May 2019.

TfW’s ‘769s’ are due to follow close behind, with five units due to be delivered for the May 2019 timetable.

Finally, GWR is scheduled to receive its first Class 769 in July. Deliveries will then run at two units per month from August 2019 to April 2020.

SIEMENS

Delivery of the last of the 25 Class 717 Desiro City units to replace the Great Northern Class 313 fleet on Moorgate services was expected during January. The fleet should have started entering service by the end of the month.

Contractual service entry for the full fleet was Quarter 3 2018. So four months late.

STADLER

British railway managers and engineers have always sought solace in the comforting belief that trains from a new supplier – preferably foreign – will automatically be better than the rolling stock they have in service. Thus in British Rail days, Metro-Cammell (later absorbed by GEC-Alsthom) was the new BREL. Contrarily, in the case of London Underground, BREL became the new Metro-Cammell.

Then Siemens, with Heathrow Express, became the new Alstom, before Hitachi, with the Class 395s for HS1 domestic services, became the new Siemens. And now Stadler is the new Hitachi, with high expectations for an immaculate entry into service with Greater Anglia.

In reality, while the first four Class 755 bi-modes are now at Norwich Crown Point depot, and testing has started, delivery has slipped slightly. Abellio is now expecting all the fleets to be in service by the end of the first quarter of 2020 (31 March). The 58 units on order are made up of 24x4-car and 14x3-car bi-modes, 10x12-car Stansted Express EMUs and 10x12-car inter-city EMUs.

Entry into service dates have still to be determined, other than ‘the middle of this year’. Abellio wants to maintain some flexibility to maximise the impact of the launch and ensure it goes smoothly.

Deliveries of the four-car bi-modes will continue, to be followed by the three-car units. EMU deliveries will then start with four of the Stansted units, followed by all the inter-city sets and finally the remaining six Stansted units. As noted in the Bombardier section, release of the modern Class 379s will help provide cover for non PRM-TSI compliant EMUs if replacement is delayed by Aventra deliveries. However, delivery of the inter-city replacement EMUs is time critical as the current Mk 3 stock loco-hauled coaches are not PRM-TSI compliant.

VIVARAIL

It would be snobbish not to conclude this review of deliveries with the smallest supplier. Like its contemporaries, Vivarail’s initial order, for the Bletchley – Bedford Marston Vale line, is already late. The delay, announced in October, was attributed to technical issues with the first diesel-electric unit. A ‘soft introduction’ is now planned to start ‘before Easter’ (21 April 2018).

Under the second order, diesel-battery electric hybrid units are being supplied to Transport for Wales for the Conwy Valley line. Delivery has not been affected by the Bedford – Bletchley delay.

But just like the big boys, Vivarail has a cascade pressure point. The new units will release Class 15x DMUs to join the Class 170s from Greater Anglia to provide additional capacity in South Wales.a